Anybody can win.

Winning is the easy part of gambling. If we want to be a profitable long term bettor then we need to learn how to lose. Here are 8 tips for dealing with losing runs:

- Be a man / woman

- Loss Aversion

- Understand the average odds magnitude

- Understanding Variance

- Length of losing runs

- Working in teams

- Replaceable bankrolls

- Move with the times

Be a man / woman

This may sound harsh, but bettors can act cowardly during a losing run. The seek to blame someone else for their run of results. A number of people lack the maturity to accept personal responsibility. They seem to enjoy playing the victim.

We see this with golf betting where someone is on the fence about getting involved. When we have 3 winners in 3 weeks they see the profit and decide now is the time. Then we proceed to bust the next 6 weeks. The 9 week period is in profit but the 6 week period is a heavy loss and guess what – the new bettor will start to question the model, the maths, the luck. They will blame anything and anyone as long as they don’t have to admit that their expectations were off. We’re not going to return 500% ROI every week when the long term ROI is 30%.

Be a man / woman. Stand up and stand tall and have personal responsibility. If things are not going the way you anticipated ask yourself some questions: am I doing anything wrong? Am I staking too high? Were my expectations misplaced? How many times in the last 3 years would a run like this have happened? And most importantly – am I really cut out for this? Not everybody is, especially if you are prone to seeing a glass as half empty.

Loss Aversion

Loss aversion is a type of cognitive bias. In psychology it has been determined that the pain of losing is can be twice as powerful as the pleasure of winning. With losing gamblers this is not so much a problem because they have an expectation of loss. With winning gamblers this is a real problem because the net experience of the life-cycle of a winning bettor is more pain than pleasure even when profitable.

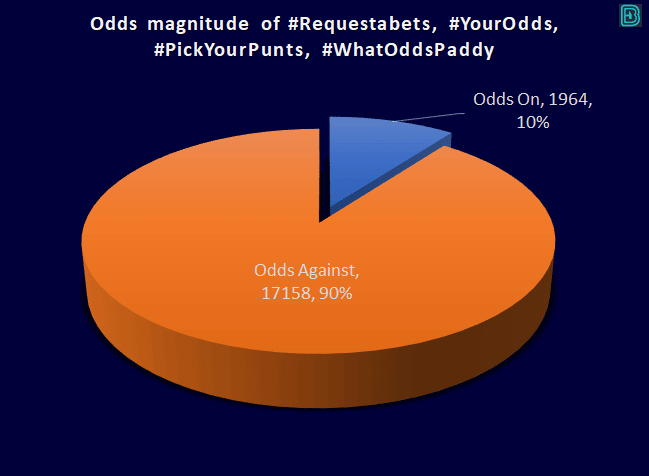

Average Odds Magnitude

The average odds we bet is usually higher than evens. This is because (1) we have a psychological proclivity towards a return that is higher than our stakes, and (2) the average odds available at a bookmaker is higher than evens.

Average odds across the trackers we monitor at bookiebashing:

- Bet tracker – 8.86

- DDHH – 33.4

- Shots on target (exchange) – 21.86

- Darts – 5.36

- Great Sports Offers – 10.02

- Combobets – 13.4

- Horse racing – 25.84

By acknowledging that 90% of bets are odds against we acknowledge that we are going to lose bets the majority of the time – even if we are employing a profitable strategy.

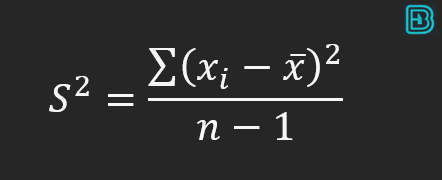

Understanding Variance and monte carlo

Mathematically variance equals the sum of the observed values minus the mean of all the observed values, squared, divided by the number of observations -1.

- S2 = sample variance

- xi = the value of the one observation

- x-bar = the mean of all observations

- n = the number of observations

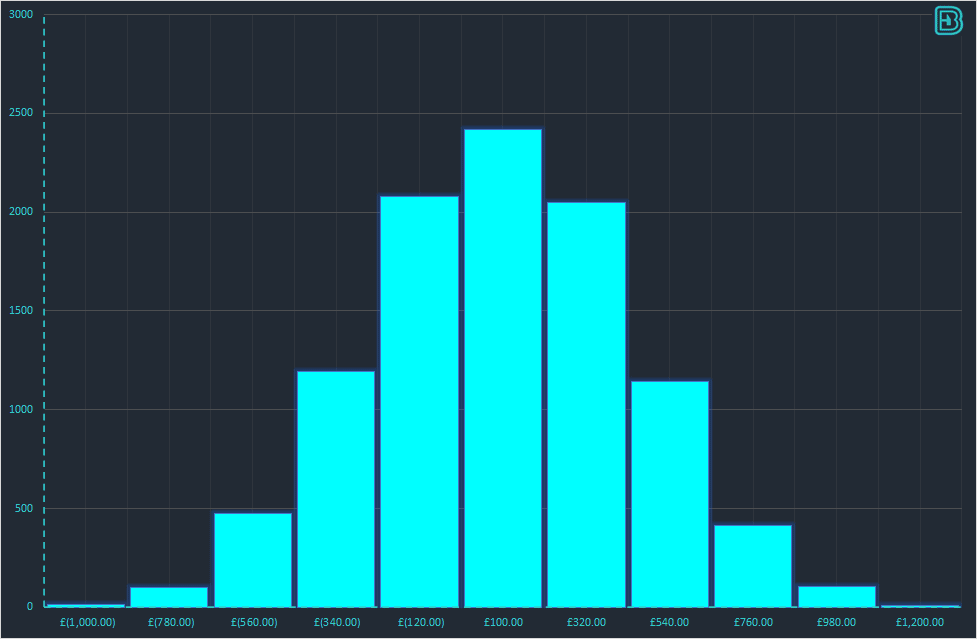

We can visualise variance by mapping a betting strategy onto a monte carlo simulation. A simple monte carlo simulation can be inputted into excel using

=(if(rand()<(odds^(-1)), -100, EV).

Suppose want to bet at odds 2.0 with EV of 120% over 10 bets. Type in the equation =if(rand()<(2^(-1)), -100, +120). Now copy this across ten columns and sum that row. The return is the outcome of one simulation using this betting strategy. Now copy this row 10,000 times and countup a distribution of outcomes.

The average profit is £93. We can plot this graph:

The monte carlo analysis and the distribution graph help us visualise the variance of a betting strategy.

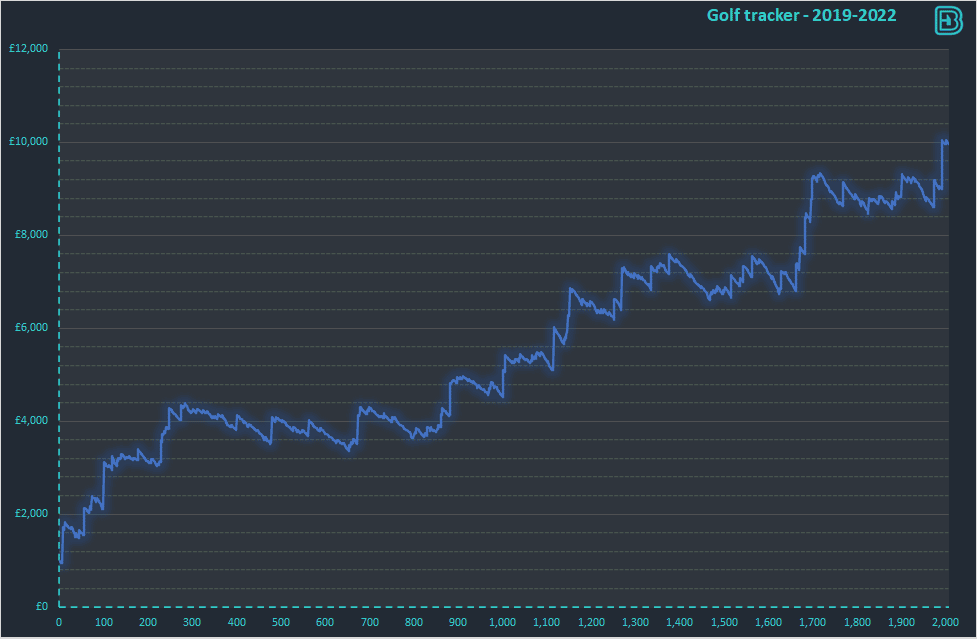

Length of losing runs

The graph above shows the return from a selection of golf bets we take from the bookiebashing tracker. We do this to approximate performance of the golf tracker. Golf betting is temporally very slow – there are usually only two tournaments per week. In horse racing we will have two races in 15 minutes. Golf betting requires a completely different mindset to betting on horses.

The graph looks very comfortable – a £1,000 bankroll in 2019 is now £10,000. However during the course of this graph many bettors have started and stopped their golf betting due to the length of time it takes variance to even out.

The period of time between bet 275 and bet 650 was 1 year. In this time we had a £1,000 downswing. Imagine betting for 52 consecutive weeks, following the progress of nearly 400 golfers in 80 tournaments and being down at the end of this. We have evidence that shows it takes character to survive an experience like this (through watching membership cancellations) and not everybody will continue through the lengths of time necessary to bet on golf.

Working in teams

Few professional bettors work on their own. There are many benefits to working in a team, and the sum of the individual components within a syndicate are greater than the individual parts. One of the best advantages of working within a team is that it is easier to navigate through losing runs. When working on your own you will find periods where you start to lose the drive and enthusiasm to continue on the same path. When working in a team it is much easier – there is always one guy (or girl) who will wake up with a “let’s go again!” mentality when you have considered putting the brakes on.

Replaceable bankrolls

We want to bet high enough when betting under a strategy to maximise our returns. However betting higher amounts increases our risk of ruin if (or when) we encounter a losing run.

The solution to this is replaceable bankrolls. If we are betting a strategy with our entire bankroll in one pot it is likely that we are fearful that our bankroll may get busted when we hit a losing run. A good alternative is to split our bankroll into pots, and to ensure that there are reserve pots in the event that a bankroll gets busted. I may have a bankroll of £10,000. I will put £1,000 towards horse racing, £1,000 towards golf and £1,000 towards football coupons. Under each £1,000 bankroll i will bet high enough that the chance of bust is around 10-20%. This allows me to bet with confidence as busting the bankroll is not the end of the world. I can reload and change strategy if necessary.

Move with the times

When I look back over the last ten years I can see fundamental shifts in the edges that have been profitable. One profitable edge is modelling same game goals, corners and cards bets (e.g. #YourOdds). Up to the beginning of 2020 these had proved highly profitable. However in March 2020 we went into lockdown, and football games ground to a halt. When they restarted they were behind closed doors and there was a fundamental shift in the number of cards, goals and corners that were recorded in each game. Without crowds the action stats plummeted to 5 and 10 year lows across the major European leagues. Without action it is difficult to beat the same game multiples which are primarily structured as “overs”. A huge losing run proceeded to run out. Perhaps we could have mitigated this by moving with the times and acknowledging that certain circumstances are not conductive to “overs” betting – such as extraordinary circumstances like a once in a lifetime pandemic.