Can we really beat the stock market, consistently, over the long term?

The short answer is – yes

In the long answer below I explain how – I will show you how we can get as much money as we want down on a weekly average return of investment of 117% – which somewhat beats the annual ROI of a stocks and shares investment firm – with the advantage that you are controlling your every move.

SkyBet announce a weekly massive price-boost. On Saturday 15th September 2018 they went with Chelsea, Arsenal and Crystal Palace at 7/1 (WAS 4/1). This is their weekly headline concession, used to drive people to the site. Each week of the season they put a huge banner on the front page, and make sure the price is well above a fair market price. They are literally giving money away, as part of a marketing strategy:

It’s important not to trust a bookmaker when they say a price boost WAS “THIS” and is NOW “THAT”. “THAT” can often still be a bad price, and blindly betting on boosts will result in long term negative expectation. To assess the value of a boost, we can compare it against the price on a betting exchange. A betting exchange often provides the most efficient estimate of a fair, true price, especially in highly liquid markets such as the English Premier League. This is because intelligent money shapes the market when it is out of line – assuring that it is very rarely out of line.

To estimate the price of a multiple on the exchange we can multiply the lay odds of each individual selection together. (We choose the lay price over the back price as this is the worst case scenario and allows us to err on the side of caution). In the example above, the lay prices were:

Chelsea 1.18

Arsenal 1.91

Crystal Palace 2.46

A fair market price for this multiple, reflecting the best estimate odds of the event occurring, would be 1.18 x 1.91 x 2.46 = 5.54

5.54 is decimal odds that includes the stake. For those used to fractional odds, it is equivalent to 4.54/1 (roughly 9/2), and this means that the odds that these three teams will all win are once every 4.54 occurrences.

We could get a price of 7/1 with SkyBet – this is obviously awesome, and a long term positive expectation strategy. It has two minor drawbacks:

- First, the upper limit of a stake will be very low, typically a tenner or less.

- After betting on a few of these boosts, SkyBet will limit your account to pennies to protect themselves from savvy punters who only bet on boosts.

Therefore it is not possible to rely on SkyBet as a sustainable means of profit. However…there are alternative options.

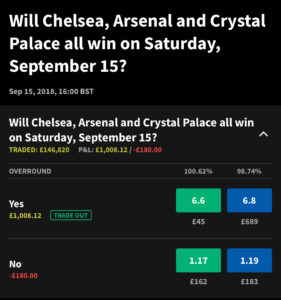

Matched betting is a popular strategy that sees people bet on an event to happen (back) at a price at a bookmaker, and bet on it not to happen (lay) at a lower price on an exchange, thus guaranteeing a profit in the long run. The exchanges cater to matched bettors, and will put up specialised markets for the layers to hedge their bets. There are many exchanges; Betfair is the biggest, followed by (in no particular order) Smarkets, Matchbook, Betdaq. The screenshot below is from Smarkets on the same day, 15th September. Smarkets have provided a market for matched bettors to lay off the SkyBet Price Boost and guarantee a profit.

Note that we discussed before that an exchange “provides the most efficient estimate of a fair, true price, especially in highly liquid markets such as the English Premier League”. Whilst the home/draw/away market of individual premiership games is highly liquid and highly efficient, specialist markets are not so efficient. The treble market above is an example of an inefficient market. In this market, the true price of the event happening is 5.54 – yet a price of 6.6 is available to back. This is because there are so many layers betting on the event not to happen (hedging their SkyBet bets) that they have driven the price upwards, forming an unrealistic price. Anyone that now backs this bet will be getting odds 6.6 (minus commission) on an event that happens once every 4.54 occasions. Commission is usually between 0-2% depending on the agreement you have with an exchange. At 2%, the net price you are getting is 6.47.

The long term expectation of this bet is 6.47/5.54 = 117%. This means that, on average, a £100 bet will return £117. In reality the bet will lose frequently, and then return £547 profit infrequently. Because this event happens every 4.54 occurrences, we see a great long term return on our investment.

Many well performing stocks and shares investment portfolios offer a return of 7%, annually. This type of bet will return an average profit of 17%, weekly. Of course, the bet will lose frequently, and therefore we have to apply bankroll management. An aggressive bankroll management strategy would be to bet 10% of our bankroll on this bet every week. If we started with £1,000, we could place £100 on this bet. If it lost, the following week we could then place 10% of £900 (£95), and if it won we could place 10% of our new higher bankroll. A Monte Carlo simulation of 10,000 runs (with outliers removed) shows a return of £3,107 (310.7%) profit on our investment.

For the risk adverse, low limit players, matching the SkyBet boost is a sure fire, legitimate strategy to earn some extra beer money for the weekend – and no-one can argue against this.

However for the big players, those with an appetite for risk and an understanding of investment, variance and bankroll management, the returns afforded by this strategy are second to none in any form of financial market. Sports gamblers and financiers alike should stand up and notice – the edge is all ours.

For a look at the variance involved in value betting – we analyse 1000 bets here, and another 1000 bets here

In summary

Applying careful bankroll management as well as understanding the nuances of market offers and exchange reliability will, over the long term, provide a better ROI to you than other (often harder to access) investment opportunities. Why not come and see what other investment strategies we share at www.bookiebashing.net?