- Benchmarking against a liquid market in an exchange

- Benchmarking against top price on Oddschecker

- Benchmarking against alternative markets on the exchange

- Benchmarking against a semi-liquid market in an exchange

- Heuristic Analysis of data

1. Benchmarking against a liquid market in an exchange

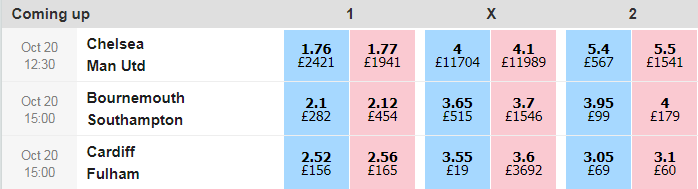

A bookmaker boosts Chelsea, Bournemouth and Cardiff all to win 12/1.

The lay price of the 1×2 (home, draw, away) market of Premier League games is an excellent benchmark of value because Premier League games exhibit the following characteristics on the exchange:

- They are highly liquid. There is plenty of money (>£100) in both the back and the lay. The odd exception is acceptable as it may just reflect imminent market movement.

- They are efficient; there are no gaps between the back and the lay. The odd exception is acceptable, as this may just reflect imminent market movement. This can be seen below in the Cardiff game. There is a gap between the back and the lay– but we still describe this market as efficient as the gap is only one increment and there is plenty of liquidity either side of the gap. The reason for this gap is the market cannot decide whether it wants to settle on a back/lay of 2.52/2.54 or 2.54/2.56.

These markets accurately reflect the best representation of public opinion, smart money and betting syndicates. If a price is wrong, it will quickly be shaped and in the long run it is safe to assume that efficient, liquid exchange markets reflect a good enough price to benchmark value against. If we can always bet on prices that beat the exchange lay price in efficient markets then we will show a long term profit.

To estimate the Expected Value we would divide the bookmaker price (13) against the multiple of the 3 lays (1.77 x 2.12 x 2.56 = 9.61):

EV = 13/9.61 = 135%.

It would be fine to use the gap price for Cardiff (2.54). The margins to which we are basing decisions on betting should not be affected by the difference in price of one increment on the exchange. The lay price is used to benchmark instead of the back to give a worst case scenario; the allows us to err on the side of caution.

2. Benchmarking against top price

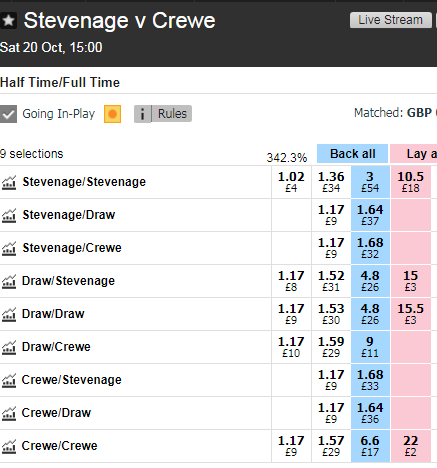

A bookmaker boosts Stevenage to win HT/FT to 3/1.

Where an exchange market is illiquid it is not possible to use it to benchmark against value.

Where there are amounts available, they are less than £100. Where a lay exists there is usually a huge gap, and the lay is missing from many prices. Stevenage vs Crewe is a secondary league football game (English League 2). The screenshot above was taken 18 hours before KO. Instead of bench-marking against the exchange we can use the fact that bookmakers are priced up, as can be seen from this table on Oddschecker:

The top price of Stevenage to win HT/FT is 3.3, at BetVictor and William Hill. It is important to note that more than 4 bookmakers have priced up this market, and 3.3 is not an outlier. We now have to factor in a markup due to the bookmakers juice.

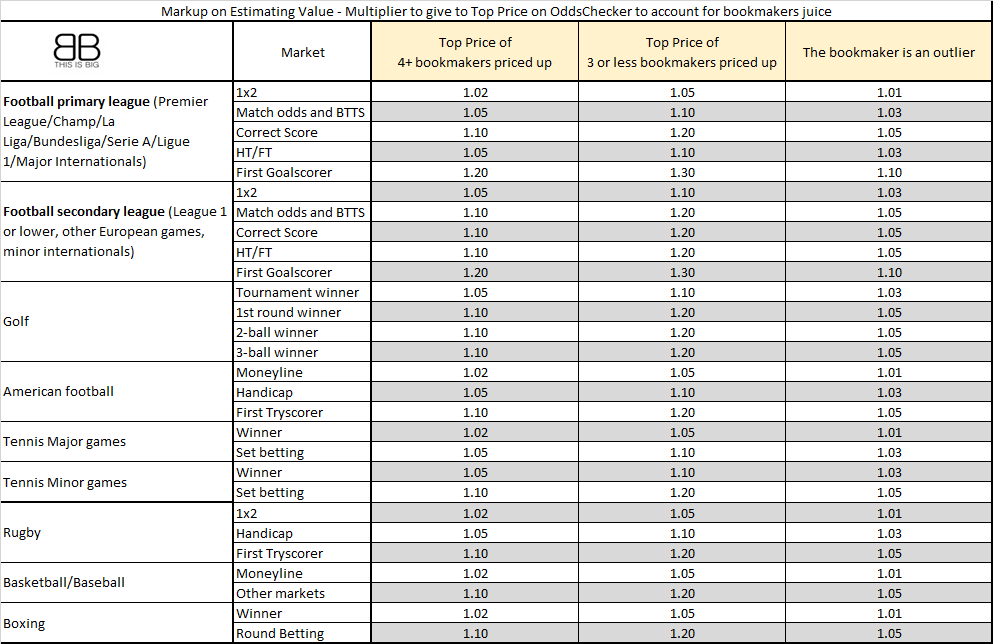

Working out the markup is an imprecise science, however we have developed the table below from years of benchmarking value at bookiebashing.net. The markup will depend on

(a) the sport,

(b) the market,

(c) how many bookmakers are priced up and

(d) whether the price is an outlier. An outlier price may be an arb, and the result of a delayed feed or latency at the bookmaker.

From this table we would use a markup of 1.1 on top of the Top Price: 3.3 x 1.1 = 3.63.

The boost price is 3/1, therefore the Expected Value of this bet is

EV = 4/3.63 = 110%.

3. Benchmarking against other markets on the exchange

A bookmaker has boosted Chelsea to win and o2.5 goals to 5/2

The screenshot below shows the Match Odds and o2.5 goals market 48 hours before the game:

The market has not formed yet. The £2 available at 1.01 is opportunistic, for all purposes this market is empty. We could use Oddschecker to benchmark against Top Price, however there are alternatives. We can use the Correct Score market to work out the value of the same bet:

Chelsea to win and o2.5 goals is the same bet as Chelsea to win 3-0, 2-1, 3-1, 3-2 or Any Other Home Win. The market above is liquid and efficient, so we can use that to benchmark value. To work out 3-0, 2-1, 3-1, 3-2 OR Any Other Home win we add together the reciprocal of all of the lay prices for these outcomes:

(1/(1/9.8)+(1/17)+(1/17)+(1/34)+(1/13)) = 3.07

As the bookmaker has boosted the price to 5/2, the Expected value of this bet =

EV = 3.5/3.07 = 114%

4. Benchmarking against a semi-liquid market in an exchange

A bookmaker has boosted Chelsea to win and BTTS to 7/2. The exchange shows the following liquidity:

Whilst the market is liquid, it is not efficient. There are huge gaps between the back and the lay price. It is difficult to estimate a benchmark price from this market. Three techniques could be:

- Use the “Middle of the Gap” – this is inadvisable if the gap is large and carries a high degree of uncertainty

- Use the “Last Price Matched” – the last price matched can be seen by bringing up the graph of each outcome in the market. This is less uncertain, but still risky, as the last person to match a price wasn’t necessarily taking a price that indicated true value.

- Use the “Worst Case Scenario” – use a price that is one increment underneath the available lay price.

Using technique (3), we can see that the EV of our bet is, at worst, 4.5/4.4 = 102%. It may be much better. We could use the last price matched to assess how cautious we are being.

5. Heuristic Analysis of data

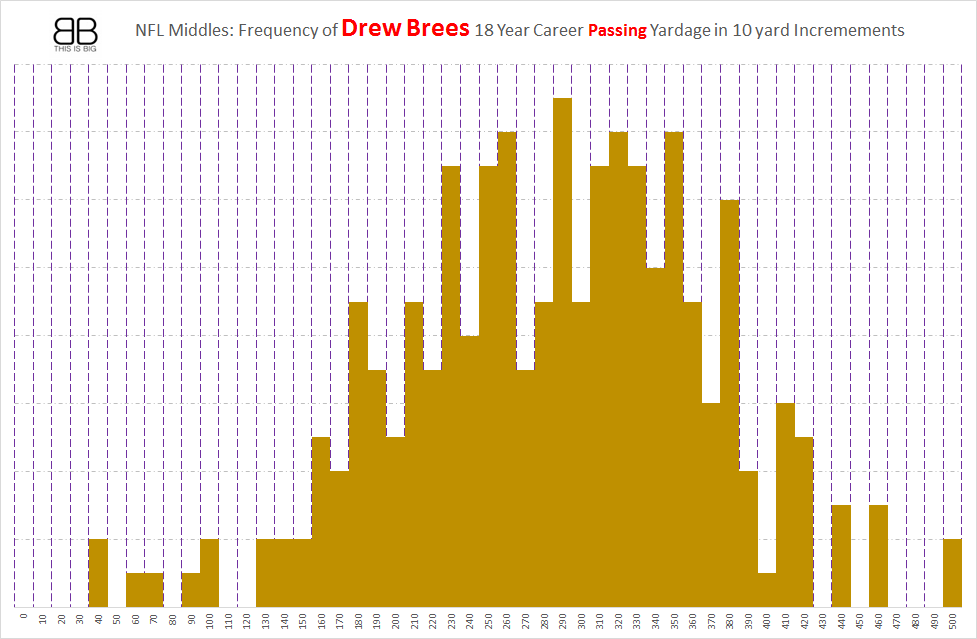

A bookmaker boosts Drew Brees to pass over 200 yards in a game to Evens.

In the absence of any other means to assess value, we can still attempt to use data to see if a price is decent. Below is the distribution of Drew Brees passing yardage over his career.

We have data to show that he has passed over 200 yards 228 times out of his 262 game career – 85% of the time. We would expect fair odds to be around 1.16 against an average opponent. Without any other information (as we can’t possibly price the market up using the same sophisticated algorithms as a bookmaker. We would have to consider form, strength of opponent, injury, weather and many other datasets we don’t necessarily have access to) a price of 2.00 against an expected average price of 1.16 can be seen to be a good long term bet.

This is the least accurate technique, with the highest degree of uncertainty. A large margin of safety is necessary to use our own datasets and analysis to prove that value is on our side.